Budgets usually mean certain restrictions and they can be daunting, especially for the uninitiated. Luckily there are numerous tools to help and in today’s blog we’ll talk about some of our favourite tools to help you map out a budget and stick to it!

One excellent resource is the plethora of financial apps on offer which can make financial management a whole lot easier.

Budgeting apps

It’s no secret that creating a budget and sticking to it is easier said than done. It is, however, a powerful way to ensure you’re managing your money correctly to realise your financial goals.

There are many budgeting apps available that can help you organise your finances properly, set your budgeting goals and keep you on the financial straight and narrow. Let’s look at some of the more popular budgeting and investing apps and how they can help you get your finances in order.

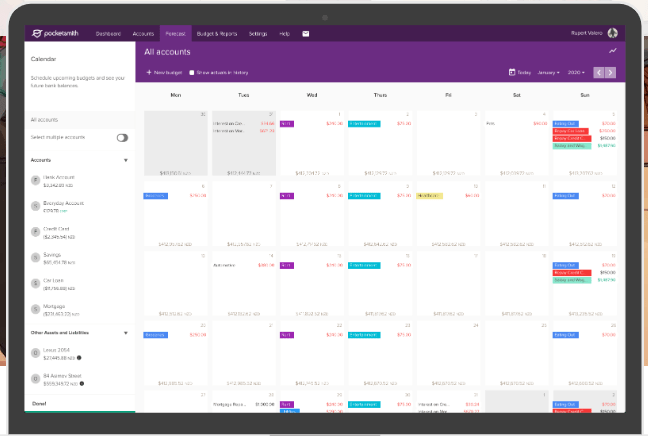

PocketSmith

This is an excellent budgeting app with a great reputation. It’s New Zealand-made which means it integrates with all our banking apps (although you’ll need the paid version for this functionality). The app offers forecasting, scenario testing and general budget tracking. If you’re already comfortable with setting and tracking budget and are ready for more advanced tools around setting future goals, then this is the app for you. The free version still offers lots of functionality and we love the automatic categorisation of different spending so you can see what you’re spending your money on.

Mybudgetpal

This is a great app that gives you a holistic view of your finances and lets you track your spending and sort it into different expense categories so you can understand where your money is going. If you’re spending a lot on make-up, dining out or takeaway confessed, this app will soon let you know! It syncs with your bank accounts and allows you to set spending limits as well as schedule upcoming bills and other payment due dates. The app is a mobile webpage rather than an app that you download via the Google Play or Apple store so it’s accessible from a multitude of devices with one login.

YNAB

You Need a Budget (YNAB) is a top contender when it comes to budgeting apps. It employs a zero-based budgeting technique. This method allocates all your funds to expenses, savings and debt payments. The end goal is to have your income minus your expenditures equaling zero at the end of the month. That way each dollar you earn gets a ‘job’ in your budget. The YNAB strategy aims to help users live within their means, get rid of their debts and save more. YNAB doesn’t yet integrate with our NZ banking apps but you can upload transactions manually using a csv file.

Other handy tools

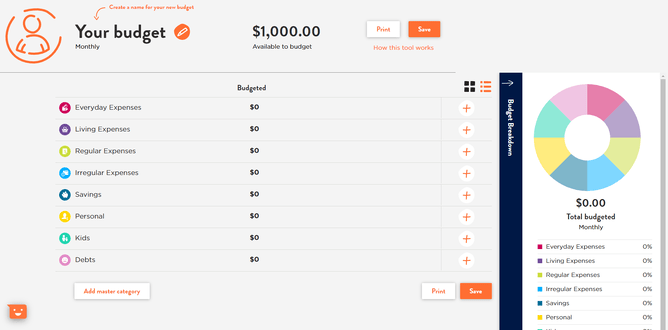

Sorted.org.nz has a plethora of financial tools available but one of the best things they offer is their budgeting tool. If you’re new to creating a budget, this online planner takes you through a simple process to set up a budget from scratch. We love that it includes expenses that you might not have even thought about such as pet food and school stationery supplies. You can also add in your own categories and remove any that aren’t applicable.

Once your budget is completed you get a great indication of where your main expenses are and how much money you need to cover everyday life. You can also export your budget – just make sure you create an account and log in to access this feature.

Work and Income

If you’re more traditional, the Work and Income website has a straightforward budgeting worksheet that you can use as a template to start from here. We recommend copying and pasting it into an excel spreadsheet which you can keep up to date with your monthly expenditure to see how well you stick to your budget each month. It’s not as pretty as the Sorted solution but it provides just as much flexibility and is a better solution if you are juggling multiple payments at different times such as monthly, fortnightly and weekly payments and don’t want to do the maths to standardise them all.

With continuous advancements in technology such as mobile apps, budgeting and personal finance is becoming more manageable and increasingly popular. One of the best things is that you have the freedom to use these tools whenever and wherever you are so why not give it a go and see if it makes a difference to your financial wellbeing!