At last, the long-awaited changes designed to save New Zealand’s housing market have been announced by the government. In this month’s blog we break down what’s been proposed, who is most likely to benefit and who will come out worse off.

Buckle in because we think we’re all in for a bumpy ride…

What have changes been announced?

For some time, the cost of houses in New Zealand has been skyrocketing with little sign of abatement. Meanwhile, there are fewer and fewer houses available, and competition is fierce between first home buyers and investors trying to buy up the limited housing stock. Meanwhile, there are not enough new homes being built to service the population.

So, what does the government plan to do about it?

Provide more support for first home buyers

The government have said that they will lift the income caps on First Home Loans so that first home buyers now only need a 5% deposit with a First Home Loan rather than a 20% deposit.

Income caps on first home grants will also be raised to provide more first home buyers with a $10,000 grant to help people with their deposit. Single people can now earn up to $95,000 (up from $85,000) and qualify for the scheme, while couples can earn up to $150,000 (up from $130,000).

The price caps on the price of homes for which the grants are available have also been raised for some cities including a cap of $700,000 in Auckland and $600,000 in Hamilton.

Many people are already arguing that these caps do not go far enough with the average property price in Auckland already well over $1 million.

Encourage property investors to invest elsewhere

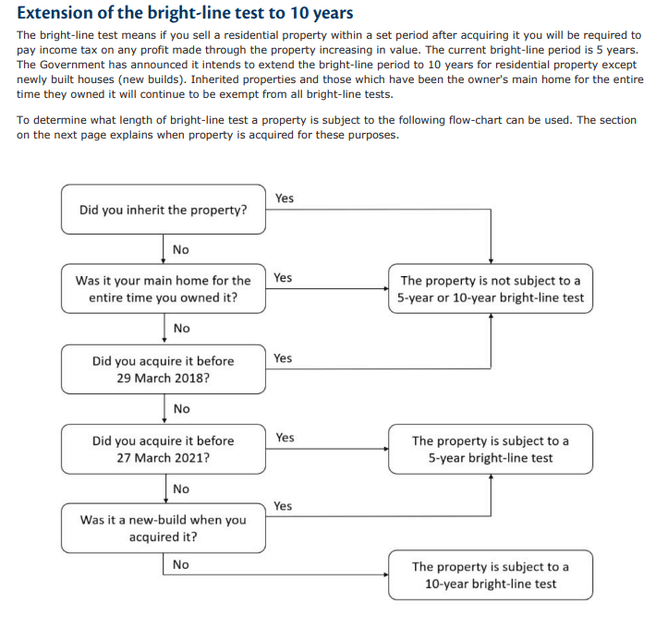

To help ‘tip the balance back towards first home buyers’ (their words) the government has said that they will extend the bright-line test. The bright-line test currently means that if you purchase an investment property and sell it within 5 years, you will be subject to paying income tax on the profits.

The government has now proposed extending the bright-line test to 10 years. For many investors, this will mean big changes to their investment plan. If you’re unsure, this handy table below will help you work out which bright-line test you may fall under.

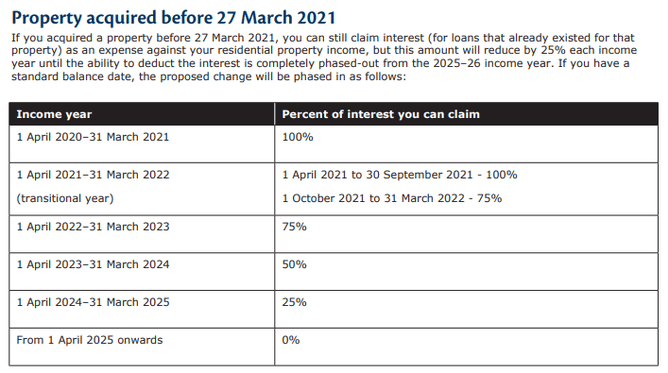

In perhaps their biggest and most concerning proposal, the government has also announced that mortgage interest will no longer be treated as an expense and therefore is not tax-deductible. The government have called this a ‘loophole’ but it’s something that is standard across all business in New Zealand.

The change means that investors with a mortgage will be liable to pay significantly more income tax than at present.

The idea is to help cool the property market so that investing in property is no longer as desirable and there are more homes available for first time buyers.

The problem is that it could have a significant impact on renters. With investors now facing tax bills thousand more than what they’ve budgeted for, rents will undoubtedly rise to help investors cover the shortfall.

We can also see a potential impact on the standard of living that renters experience. Currently property investors have greater cashflow allowing them to invest the money back into their properties. The changes mean that cashflow will be restricted and instead of putting money back into the property, investors may squirrel the cash away to pay the tax man at the end of the year.

The changes won’t come into effect immediately, so investors do have time to plan. This table shows when the changes will come into force.

Incentivise new builds

While in some instances the government is openly acknowledging that they’re trying to get houses out of investor’s hands, when it comes to new builds, they want to incentivise property investors to get on board (any property investors feeling like a puppet right about now?).

If you invest in a new build, you will be exempt from changes to interest deductibility and the 10 year bright-line test. The five year bright-line test will still be in play.

Make it easier for new homes to be built

The government has also announced initiatives to help make it easier to get new builds off the ground. This includes a Housing Acceleration fund to help support infrastructure surrounding new builds including roading and pipes.

They’ll also be extending the Apprenticeship Boost payment to help support more tradespeople to get into the construction industry with free apprenticeships and training.

You can find out more here.

More information

These changes have not yet been written into law, that’s what comes next so there may still be slight changes ahead.

If you want to find out more, we recommend the following sources:

Price cap changes for first home buyers – stuff.co.nz

In-depth analysis of bright-line and interest deductibility changes – interest.co.nz

Apprenticeships Boost – Work and Income