With Coronavrius (COVID-19) sweeping the globe and a pandemic having been declared, financial markets around the world have certainly been affected with significant falls across the board

If you’ve got investments in shares or managed funds, it is very likely that you will have seen drops in the performance of your investments.

However, now is not the time to panic, there are lots of moving parts involved. In this month’s blog we look at why the drops are happening and how you should react.

Why are the financial markets being affected by COVID-19?

It’s not unusual for the financial markets to be hit when an outbreak of a virus such as COVID-19 occurs. In fact, it is commonplace as shareholders see the impact that the virus could have on share markets and sell their shares in fear of losing money.

History shows us that because of this reaction, the price of shares does fall, and financial markets lose their value as shareholders pull out.

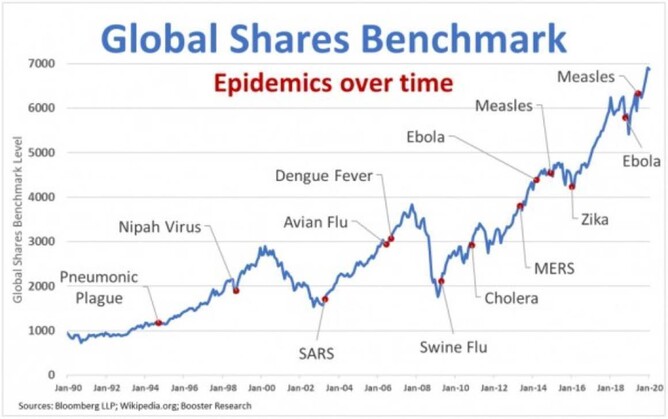

However, history also shows us that the markets always correct themselves. There have been many outbreaks of disease in decades gone by and each time the economy has recovered and eventually risen higher.

The graph below shows the small blips that have occurred in the past when outbreaks have occurred but equally shows how share prices have recovered.

How should you react?

We strongly advise that you focus on the long term and let your investment portfolio ride out the storm. Forecasts suggest that the impact will be brief and with portfolio values dropping it is recommended that you ride the storm out.

While it may be difficult to watch your investments dropping in value, the best bet is to hold tight and wait for the recovery.

Look for the positives

There are two primary positives that often come with a downturn.

The first is that when markets and share values drop, this often means an interest rate cut as the reserve bank works to help bolster the economy.

Of course, interest rate cuts are often not good news for savings and investments. But it can mean positive things for homeowners as mortgage rates will drop.

If you’re not locked in a long fixed-term loan, you should be able to reap the benefits of interest rate drops by fixing your mortgage at a lower rate.

Have a chat to our in-house home loan team as we can review your current loans and identify any opportunities to take advantage of lower rates.

The second positive of economic downturns is that the drop of value in share prices mean they are generally cheaper to buy.

Astute investors often use this opportunity to purchase shares at a lower price and reap the benefits of their improved value as the market corrects and values go back up.

What next?

If you’re feeling concerns about the performance of your investment portfolio do get in touch with us. We’d be happy to talk through what’s going on and make any suggestions that we think would suit your investments.

Please remember that if you have been through the retirement planning process with us, these kind of events have been factored in. If not, please feel free to contact us and we can talk about how we might be able to help you.