Interest Rate History

We’re pretty used to the idea that the bank pays us interest on the money we have in the bank so how would you feel if you had to pay to keep your money in the bank? It might sound like a hypothetical situation but that’s effectively what some extremely wealthy customers in Germany are required to do thanks to the introduction of negative interest rates.

Negative interest rates were first introduced in Europe in June 2014 as an economic growth measure. Basically, the idea behind it was to combat deflation by driving cash back into the economy to stimulate growth. It’s an interesting economic tactic, but not one we’re likely to see in New Zealand any time soon. (If you’d like to learn more about this topic, this BBC news article Why Use Negative Interest Rates? explains it well.)

Central bank interest rates around the world vary with rates currently as low as -0.075 percent in Switzerland and just over 10 percent in Brazil. While the Official Cash Rate (OCR) in New Zealand is currently 1.750 percent, it’s 1.500 percent in Australia, 1.250 in the US, and 0.250 in Britain.

New Zealand introduced the Official Cash Rate in 1999 and today it sits at 1.75 percent. This record low was announced in November 2016 and has remained unchanged since then. Mortgage interest rates tend to go up and down along with the equivalent rise or fall of the OCR.

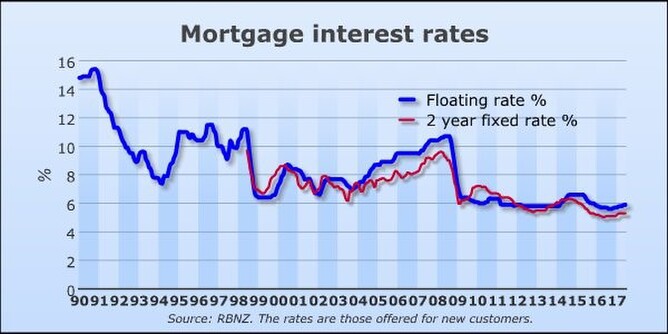

Above is a graph from the Royal Bank of New Zealand (RBNZ) showing the changes to mortgage interest rates from 1990 to 2017. Over this 27-year period, interest rates have been as high as 15 percent to today’s low of around five to six percent.

We tend to be unhappy with rising interest rates when we have a home loan mortgage. However, if you have savings in the bank, an interest rate rise can spell good news. Naturally, that flips around when rates go down. You can’t change the interest rates, but you can use them to your advantage. Buying property when rates are low can be a good investment option.

When it comes to mortgages, there are many types. All with different interest rates, fees, and flexibility. These affect how much the loan costs and how it fits your lifestyle and long term financial goals. Your interest rate may be fixed or floating and there are different repayment structures to choose between.

By understanding the best deals in the market and giving you access to these, along with the leverage to negotiate, you can ensure you’re getting the best deal for you – not the best deal for the bank.

If you are looking to buy a new home, or have a fixed interest rate loan that expires soon, we can help you work through the different options to ensure you obtain the best rate to suit you and your current lifestyle. Because we don’t work for just one bank, your needs are put first.

Contact our team to discuss your home loan questions: kj@nzadvicegroup.co.nz or 0800 230 235