New Claims Data for 2023

In the ever-evolving landscape of insurance, understanding how claims are managed and paid out can provide policyholders with peace of mind and confidence in their coverage. Recent data from two leading insurance providers, AIA and Chubb, offers valuable insights into the current state of claims in New Zealand, highlighting the significant support these companies provide to their clients during challenging times.

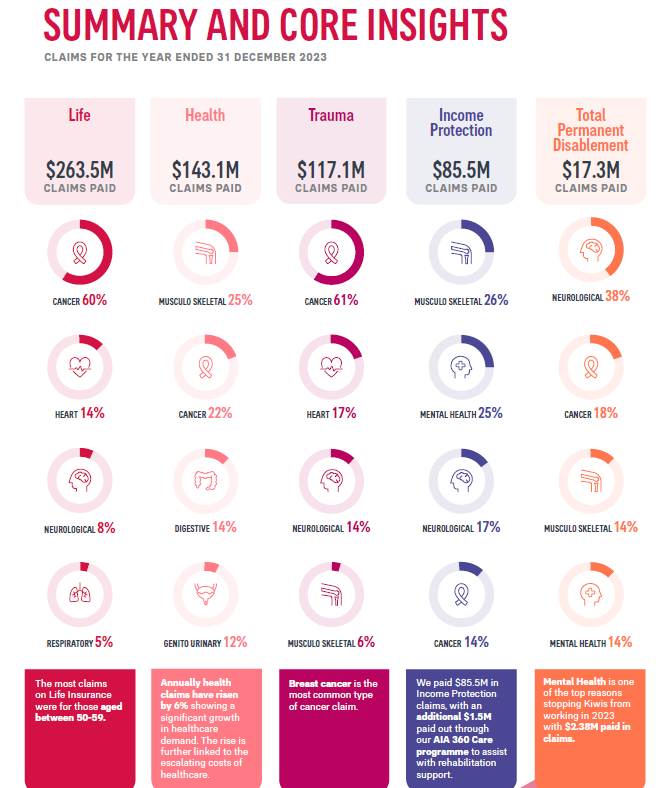

AIA's Impressive Claims Payouts in 2023

AIA, a prominent player in the insurance market, has demonstrated its commitment to supporting policyholders through substantial claims payouts in 2023. The company paid out a staggering $734 million across various types of insurance, including Life, Health, Trauma, Income Protection, and Total and Permanent Disability (TPD) insurance. This substantial payout underscores AIA's financial strength and dedication to fulfilling its promises to policyholders.

Breakdown of AIA's Claims Payouts:

Life Insurance: Ensuring families are financially protected in the event of a loved one's passing.

Health Insurance: Covering medical expenses and treatments, providing policyholders with access to necessary healthcare.

Trauma Insurance: Offering financial support following critical illnesses or severe injuries.

Income Protection Insurance: Replacing lost income when policyholders are unable to work due to illness or injury.

Total and Permanent Disability (TPD) Insurance: Providing financial assistance when policyholders are permanently unable to work due to a disabling condition.

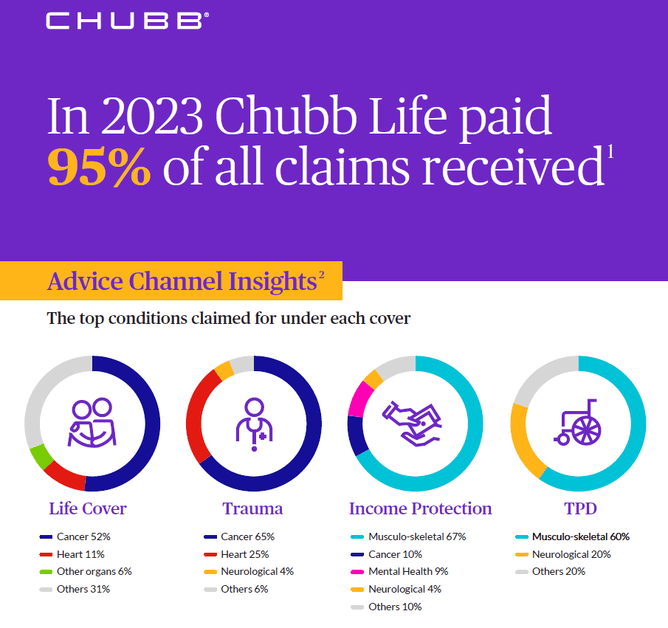

Chubb, another leading insurance provider, has also shown a strong commitment to its policyholders by approving 95% of all claims received in 2023. This high approval rate is a testament to Chubb's efficient claims processing and dedication to supporting clients during their times of need.

Key Trends in Claims: Cancer and Mental Health

Both AIA and Chubb's data reveal significant trends that are crucial for policyholders to understand:

The Prevalence of Cancer Claims

Cancer has emerged as the most prominent cause for claims across both companies. This highlights the importance of having comprehensive insurance coverage that includes protection against critical illnesses. Early detection and advanced medical treatments have improved survival rates, but the financial burden can still be overwhelming. Insurance policies that cover cancer treatments can provide much-needed financial relief during such challenging times.

The Rise of Mental Health Claims

In addition to cancer, mental health claims have been increasing year on year, becoming one of the top reasons stopping New Zealanders from working. The growing awareness and recognition of mental health issues have led to more people seeking help and filing claims for related treatments and support. This trend underscores the need for insurance policies that adequately cover mental health services, ensuring that policyholders receive the care they need without financial stress.

The Importance of Comprehensive Insurance Coverage

The data from AIA and Chubb highlights the importance of having comprehensive insurance coverage that addresses a wide range of potential risks. Life is unpredictable, and having the right insurance policy can make a significant difference in one's ability to navigate unforeseen challenges. Whether it's through life insurance, health insurance, or income protection, having a safety net in place can provide peace of mind and financial stability.

Conclusion: Making Informed Insurance Choices

As insurance clients, it's essential to stay informed about the performance and reliability of insurance providers. AIA and Chubb's recent claims data for 2023 provide valuable insights into their commitment to policyholders and their ability to deliver on their promises. By understanding the trends and coverage options available, policyholders can make informed decisions that best meet their needs and ensure they are adequately protected in times of need.

Time for a review?

We are a quick email or call away from a review of your cover to make sure you have the right coverage in place for your current situation. Get in touch today, 0800 230 235 or josh@nzadvicegroup.co.nz